Any device which intended to be prejudicial to the interest of Malaysia or unsuited with peace. Chart of The Day.

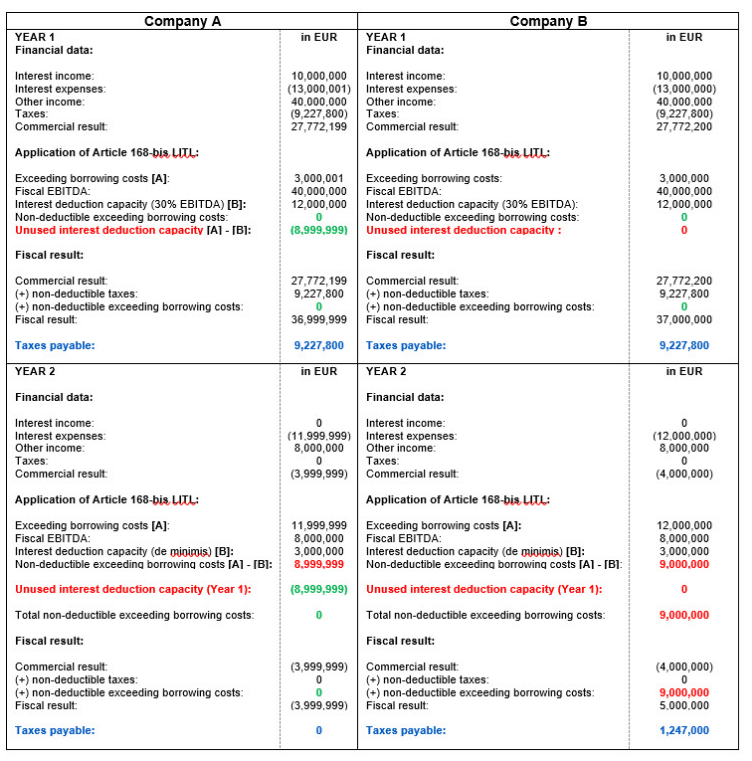

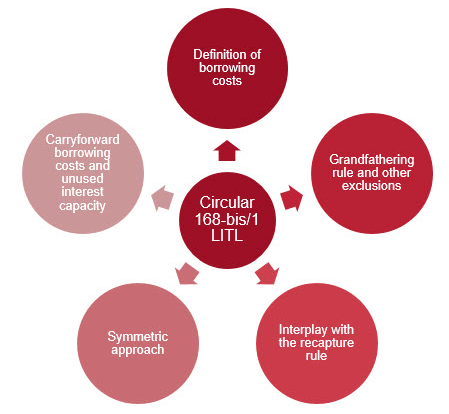

Luxembourg Interest Deduction Limitation Rule New Guidance Released By The Luxembourg Tax Authorities

She was the pivotal Democratic vote in the 50-50 Senate and wanted the levy on wealthy.

. Issues of interest restriction and allocation can arise when a company has an interest expense and a variety of income-producing and non-income-producing investments. Selling price of each type if there are many different types ie. Transfer Your Debt and Pay 0 Interest Until 2024.

But it came at a price. Dropping a provision that would have narrowed a tax break for carried interest altering a 15 minimum tax on corporations and adding a new 1 excise tax on stock buybacks. The Rules which came into operation on 1 July 2019 provides that there is now a maximum threshold on the allowable deduction on interest expense for a YA in the context of group financing.

General power to exempt or exclude. In addition the net interest deduction of the UK. A 175 has been introduced to restrict deductions for interest expenses or any other payments which are economically equivalent to interest to ensure that such expenses commensurate with the.

The Unregistered User shall comply. This is an unofficial consolidation. Since 1971 the UPM Alumni list has grown to an impressive list of 145000 people - not only in Malaysia but from all over the world including Australia Iran France Myanmar and Saudi Arabia.

However the implementation of the thin capitalization rules was deferred to the end of. Intoxicating liquors containing more than 346 milligrams per liter in any lead or in any compound of copper. Following that the Income Tax Restriction on Deductibility of Interest Rules 2019 Rules was gazetted for the implementation of Section 140C of the MITA.

Additional provisions as to offences under sections 113 115 116 118 and 120 122. The original Constitution was first introduced as the Constitution of the Federation of Malaya on Merdeka Day 31 August 1957 and subsequently introduced as the Constitution of Malaysia on Malaysia Day 16 September 1963. Minister may prohibit employment other than under contract of service.

The main religion embraced by the Bugis is Islam with a. Number of parking lots. Cocoa pods rambutans pulasan longan and nam nam fruits from Philipines and Indonesia.

Tenure of the land expiry date any restriction in interest if there is Description of the development. The key was getting Senator Kyrsten Sinema over the line. Omkar Godbole looks at a rare signal hinting bitcoin could be at market bottom and why this might be the best time to add exposure to the cryptocurrency.

Smoking bans or smoke-free laws are public policies including criminal laws and occupational safety and health regulations that prohibit tobacco smoking in certain spaces. The Bugis people also known as Buginese are an ethnicitythe most numerous of the three major linguistic and ethnic groups of South Sulawesi the others being Makassar and Toraja in the south-western province of Sulawesi third-largest island of IndonesiaThe Bugis in 1605 converted to Islam from Animism. Last amendment included here is the Federal Constitution Amendment Act 1995 which entered.

Armed with a desire to foster fraternity with their Alma mater UPM Alumni have managed to share great ideas and speak critically for the development of a dynamic university in the. The Unregistered User acknowledges the Registrys proprietary interest and copyright in the data and documentation provided in connection with e-Search Services and undertakes not to sell the data in any form or make copies of the documentation from which products may be derived for resale without the prior written consent of the Registrar. Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel.

In Malaysia our winding up laws were originally contained in our Companies Act 1965 and with some minor cross-referencing to the Bankruptcy Act 1967. 4 Laws of Malaysia A CT 53 Section 7. Hence the very persuasive value that we can draw on English and.

Failure to comply with rules made under paragraph 1541c on mutual administrative assistance 120. 35 Rules People Who Go on Fixer Upper Have to Follow. The Malaysian Income Tax Country-by-Country Reporting Rules 2016 The Rules PUA 3572016 has been gazetted on 23 December 2016The Rules applies to Multinational headquartered in Malaysia having total group revenue of more than RM3 billion in the year 2016 in which they are required to furnish their aggregate tax jurisdiction-wide information relating to.

In turn the Companies Act 1965 was based on the English Companies Act 1948 and the Companies Act 1961 of the Australian state of Victoria. The spaces most commonly affected by smoking bans are indoor workplaces and buildings open to the public such as restaurants bars office buildings schools retail stores hospitals libraries transport. From 1 April 2017 and subject to a GBP 2 million de-minimis per annum the CIR rules impose a fixed ratio limiting corporation tax deductions for net interest expense to the higher of 30 of UK earnings before interest taxes depreciation and amortisation UK EBITDA and the group ratio for highly geared groups.

All genuses of Piranha fish. Effect on Act of other written laws. As of 1 January 2009 thin capitalization and transfer pricing provisions have been introduced to the ITA.

Tax etc payable notwithstanding. Bitcoin appeared unaffected by the news of the Bank of England announcing its biggest interest rate rise in 27 yearsThe pound dropped against the dollar. Type A Type B etc Maximum minimum selling price of each type where applicable Number of units available for each type.

Name of the development. PART I - PRELIMINARY. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU.

4 Credit Cards Charging 0 Interest Until 2024. Companies and bodies of persons 9. Short title and application.

Newsletter 33 2019 Restriction On Deductibility Of Controlled Party S Interest Expense Page 002 Jpg

Palladium Holdings Pty Ltd Certain Tender Offers Business Combinations And Rights Offerings In Which The Subject Company Is A Foreign Private Issuer Of Which Less Than 10 Of Its Securities Are Held

Pdf Balancing Freedom Of Speech And National Security In Malaysia

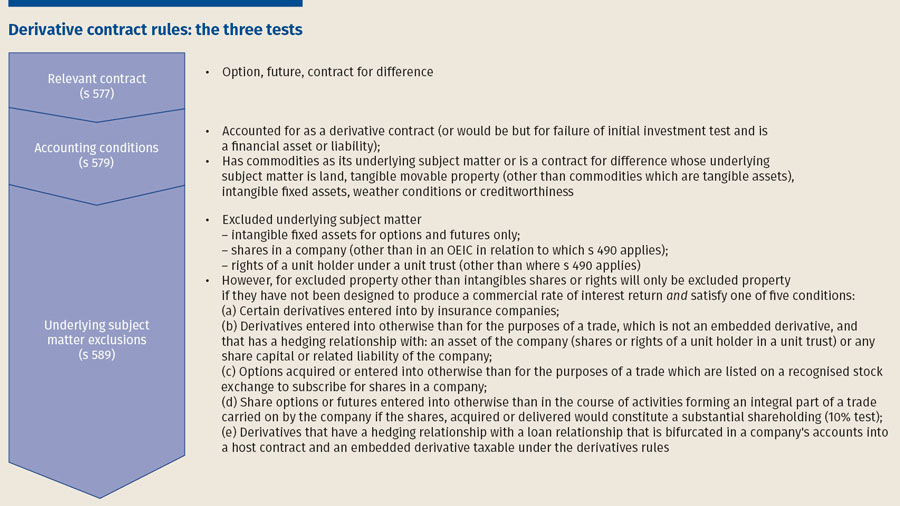

Derivatives And Complex Financial Instruments An Introduction

Thin Capitalization Rules Limitation On Interest Expenses Mint

Pdf Freedom Of Movement An Analysis

Pdf Procedural Laws Governing Event Of Default In Islamic Financing In Malaysia Issues And Challenges

Newsletter 30 2018 New Information Required For Company Income Tax Return Form E C For Ya 2019 Page 001 Jpg

Newsletter 33 2019 Restriction On Deductibility Of Controlled Party S Interest Expense Page 001 Jpg

Luxembourg Interest Deduction Limitation Rule New Guidance Released By The Luxembourg Tax Authorities

Newsletter 35 2019 Restriction On Deductibility Of Interest Guidelines Page 001 Jpg

Company Law Notes Introduction Company Is A Form Of Incorporated Business Organisation Which Is Studocu